Product Stewardship

Reduce your environmental impact.

Product stewardship is when all stakeholders share responsibility for the environmental impacts that products cause over their life cycle. We like to think of it as a focus on doing things better, together.

Take control of the impact your product has on the environment. We can provide the experience and expertise you need to make your product stewardship a success. We can scope, project manage and implement your programme across designers, suppliers, producers, distributors and consumers. Together we can spot the opportunities; drive change; and deliver a real difference.

Download and read our guide to product stewardship

Why product stewardship?

Product stewardship is when: “a producer, brand owner, importer, retailer or consumer takes responsibility for reducing a product’s environmental impact”.

If you’re a New Zealand business; product stewardship makes sense. That’s not just because consumers and employees want to work with businesses that consider sustainability when making and selling their products. Your shareholders also need you to protect their investment by looking after the future of your business.

Sustainability and reduced waste continue to grow in importance. That’s driving governments and regulators to introduce new regulations and push industry and businesses like yours to make positive changes.

Start planning for the future of your business and begin your product stewardship journey with us today.

Let’s get startedWhy 3R?

The guidance your business needs

Product stewardship can be complicated. We can help your business or industry group identify and explore the best opportunities then make them happen. With our Sustainable Futures Accelerator we have created a robust process that ensures your product stewardship success.

We work with regulators as well as businesses. We understand the opportunities for accreditation, compliance certification and industry or government support. We can connect your business with others like yours. Collaboration often creates the strongest opportunities for environmental change.

Whatever your industry, product or service, we’re confident we can help. If you’re ready to invest in product stewardship; we can make sure it will improve your environmental position.

Let’s get startedThe support you need

Our service has been designed to provide the right support to your business, however you’re approaching your investment in product stewardship.

We provide support for:

- Voluntary product stewardship schemes (non-regulated products)

- Regulated product stewardship schemes (regulated products)

- Product take back schemes

- Facilitation of design / co-design process

- System design and material flows

- Mass balance research and modelling

- Financial modelling

- Funding pathways

- Scheme implementation and management

- Operational support

- Advocacy, stakeholder engagement and marketing

- Governance structure and policies

- Accreditation support for applications to the Ministry for the Environment

Contact our team today and connect our experts with your sustainability journey

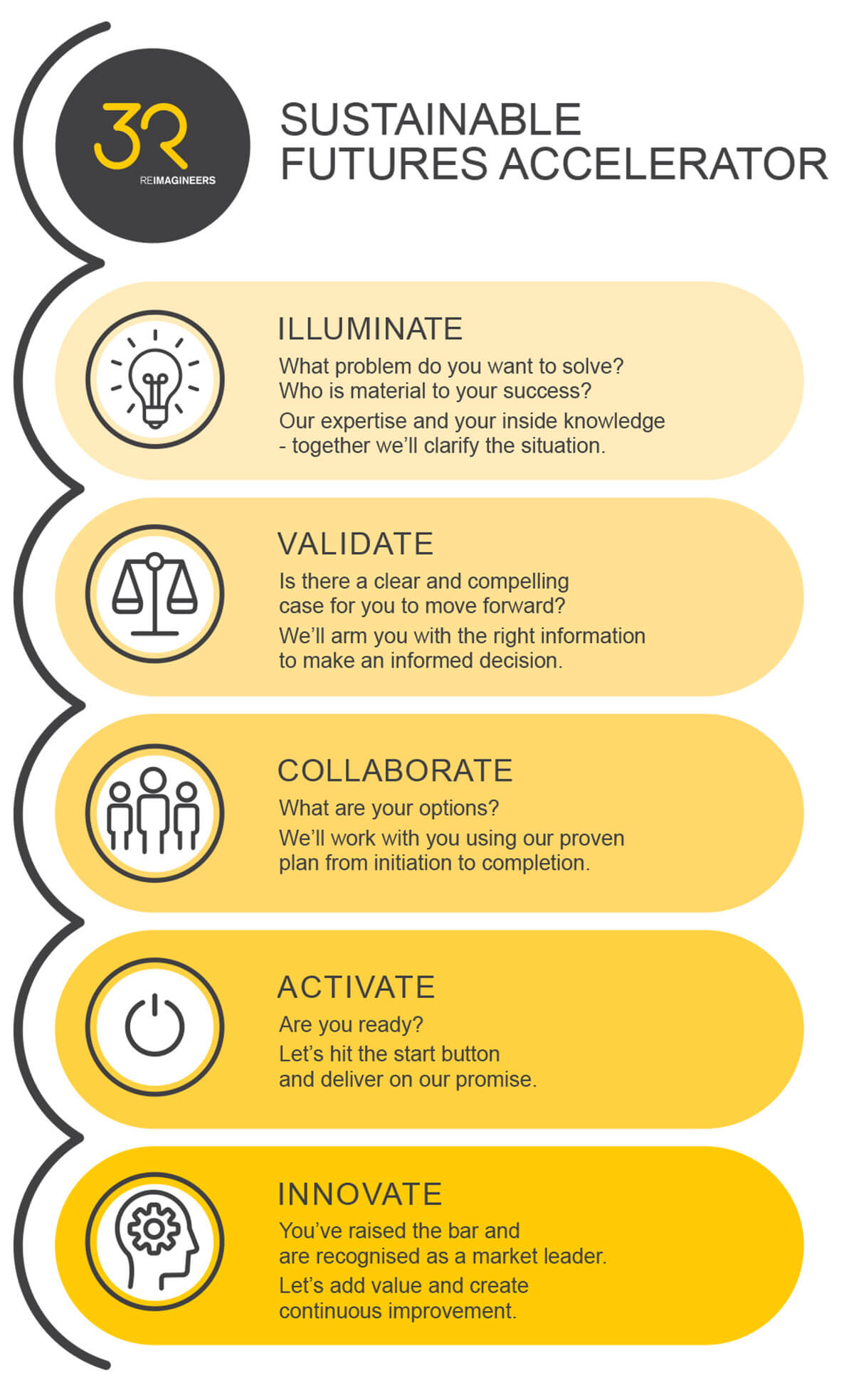

Sustainable Futures Accelerator

Our sustainable futures accelerator is a process developed from years of experience. It will help you assess where you are now on your sustainability journey, and accelerate it into the future.

-

Illuminate

What problem do you want to solve? Who is material to your success? Our expertise and your inside knowledge – together we’ll clarify the situation.

-

Validate

Is there a clear and compelling case for you to move forward? We’ll arm you with the right information to make an informed decision.

-

Collaborate

What are your options? We’ll work with you using our proven plan from initiation to completion.

-

Activate

Are you ready? Let’s hit the start button and deliver on our promise.

-

Innovate

You’ve raised the bar and are recognised as a market leader. Let’s add value and create continuous improvement.

Frequently asked questions

Answers to some of the questions we are often asked about product stewardship. Do you have more questions? Read our articles or contact us.

-

What is product stewardship?

Product stewardship is when responsibility for the environmental effects that products cause in their life cycle is shared among all stakeholders involved with the product. Product stewardship participants can include producers, brand owners, importers, retailers, and consumers.

-

Why do we need product stewardship?

In 2018 the World Bank put New Zealand in 10th position for the most wasteful countries in the world, generating around 750kg per person per year.

Product stewardship is recognised globally as an effective tool to reduce waste. It allows you to work right across the whole supply chain and engage all stakeholders, with a common goal of driving change across the supply chain, minimising waste to landfill and increasing the circularity of resources.

-

Product stewardship programme vs take back scheme

There’s no formal definition between product stewardship and take back but generally it’s accepted that a stewardship programme takes greater responsibility for the product’s environmental impact than a take back scheme.

Product stewardship aims to work across the supply chain to ensure all negative aspects are addressed at every point, while a take back scheme generally focuses on just that – take back of the product at end of life.

-

What is the difference between voluntary and regulated product stewardship?

Voluntary stewardship is just that – organisations, whether they are producers, importers or retailers, who choose to take responsibility for the environmental impact of their product. A voluntary product stewardship scheme may ensure responsible disposal or recycling and encourage redesign of a product for reuse or increased recyclability. These schemes can be industry-wide, a group of businesses or a driven by an individual business.

With regulated stewardship, the Government uses the tools in the Waste Minimisation Act 2008 to mandated participation in stewardship. They may choose to do this where there is significant harm from the product at end of life or any voluntary stewardship scheme in place is not effective. Regulated stewardship creates a level playing field by mandating participation from all producers, importers and retailers.

3R works in both voluntary and regulated stewardship.

-

What is a priority product?

Under New Zealand’s Waste Minimisation Act 2008, products which are deemed to cause significant environmental harm when they become waste; have significant benefits from reduction, reuse, recycling, recovery, or treatment of the product; and can be effectively managed under a product stewardship scheme can be declared priority products. In 2020, six products were declared ‘priority products’ and it’s expected there will be more to follow.8. Following a declaration of priority product there is a requirement for those responsible for producing, importing and/or selling a product to be part of a regulated product stewardship programme.

-

What if my products are already part of a voluntary scheme?

Many products covered by the priority product declaration in 2020 are already part of voluntary product stewardship schemes. Under the regulations, the scheme needs to submit their existing scheme for accreditation under the regulations, otherwise the brands can join an industry-wide co-design process.

-

What is an accredited scheme?

An accredited scheme refers to one which has been assessed and approved by the government against a set of rules or guidelines. It is usually accredited for a seven-year period and annual reporting is expected.

Accredited schemes can be voluntary or regulated. Voluntary schemes can choose to be accredited, whereas regulated schemes must be accredited.

-

How is product stewardship funded?

An advanced disposal fee or levy is the typical means of covering the costs of a product stewardship programme. In this way, the costs are covered in the price of the product at point of sale and cover free recovery when the consumer is finished with the product.

What’s new?

Stay up to date with our latest product stewardship projects.